Comments

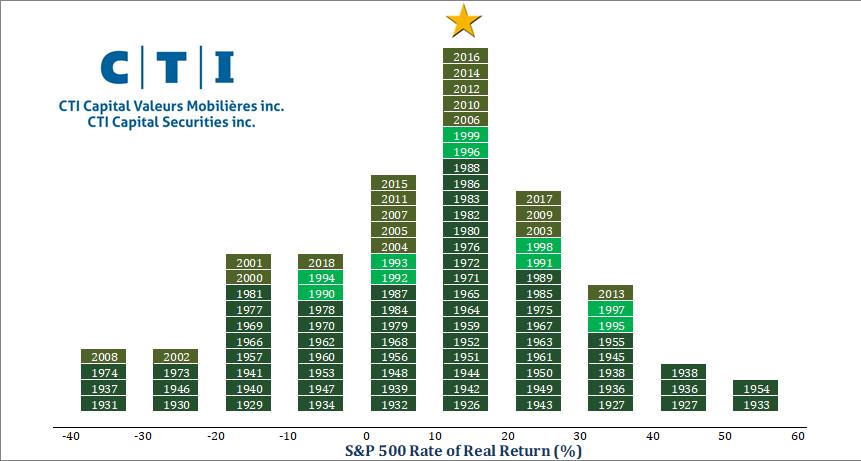

Happy Holidays from the Stock Market

24/12/2019

The team at CTI Capital Securities Inc. would like to extend to all of our clients its best wishes for the holidays and a wonderful and prosperous New Year.

L’équipe CTI Capital Valeurs Mobilières Inc. aimerait souhaiter à tous nos clients ses meilleurs vœux pour la période des fêtes ainsi qu’une belle et prospère Nouvelle Année.

Ivan Greenstein, Stephan Buu, Émile Bordeleau

Institutional Bond and Equity Desk

CTI Capital Valeurs Mobilières Inc.

Tel : (514)-861-0240

Fax: (514)-861-3230

Institutional Bond and Equity Desk

CTI Capital Valeurs Mobilieres Inc.

Tel : (514)-861-0240

Fax: (514)-861-3230

20/12/2019

Market Update

Tsys lower on low volume before Q3 GDP/PCE data, 10Y 1.93% (+1bp), US equity futures slightly positive , S&P +1.75, USD index at weekly high. The US 2s10s steepened yesterday to the widest since Nov 18 while 10Y breakevens are at the highest since July. Core EGBs lower , UK Q3 GDP revised higher to 0.4% from 0.3% due to stronger services and exports. GOC yields 1bp higher before Oct Retail Sales (0.5% exp). Big move in 30Y breakevens yest, 4bps in line with move in US breakevens.

News headlines

U.S. Futures Drift, Europe Stocks Gain; Bonds Slip: Markets Wrap (Bloomberg) U.S. equity futures fluctuated in a tight range while European stocks climbed as investors counted down to the holiday season. The dollar edged higher and Treasuries declined.

TSX futures gain on new North American trade deal (Reuters) Futures for Canada’s main stock index rose on Friday, following the approval of a new trade deal between the United States and its neighbors Canada and Mexico.

Oil Heads for Third Weekly Gain on U.S.-China Trade Optimism (Bloomberg) Oil is on track for a third weekly advance as the U.S. and China made progress toward a phase-one trade deal, supporting the outlook for fuel demand.

Wall Street Week Ahead: History suggests rally may slow for U.S. stocks in ’20 (Reuters) The outsized rally in the U.S. stock market this year may give way to a more muted performance in 2020 if history is any guide.

Two deals in pocket but no holiday cheer for U.S. trade chief Lighthizer (Reuters) U.S. Trade Representative Robert Lighthizer was looking forward to some holiday peace and quiet after wrapping up trade deals with the United States’ most important trading partners – China, Mexico, and Canada – last week.

China can fulfil $40 billion U.S. farm purchase pledge: consultancy (Reuters) China will make good on a pledge to purchase more than $40 billion per year of U.S. agricultural products under the recently agreed Phase 1 trade deal between the two countries, China’s top agriculture consultancy said on Friday.

UK economy’s growth in third-quarter revised up, smallest current account gap since 2012 (Reuters) Britain’s economy grew a little faster in the third quarter than first estimated and the country’s current account deficit shrank to its smallest since 2012, a small boost ahead of what looks set to be a sluggish end to the year ahead of Brexit.

UK PM Johnson: There will be no alignment with EU rules in future relationship (Reuters) British Prime Minister Boris Johnson said on Friday there would be no alignment with European Union rules under the terms of the free trade deal he wants to strike with the bloc next year.

House follows Trump impeachment by passing NAFTA overhaul (BNN) The day after voting to impeach President Donald Trump, the House approved his top 2019 legislative priority by advancing the U.S.-Mexico-Canada trade accord.

Market Overview: US 10yr note futures are down -0.17% at 128-03, S&P 500 futures are up 0.06% at 3213.75, Crude oil futures are down -0.33% at $60.98, Gold futures are down -0.09% at $1483.1, DXY is up 0.14% at 97.512, CAD/USD is up 0.14% at 0.7608.

| Cda Benchmarks | Yield | Tsy Benchmarks | Yield |

| 2 Year | 1.704% | 2 Year | 1.636% |

| 5 Year | 1.683% | 5 Year | 1.744% |

| 10 Year | 1.67% | 10 Year | 1.931% |

| 30 Year | 1.722% | 30 Year | 2.36% |

US Economic Data

| 08:30 AM | GDP Annualized QoQ, 3Q T Survey: 2.10% Prior: 2.10% |

| Personal Consumption, 3Q T Survey: 2.90% Prior: 2.90% | |

| GDP Price Index, 3Q T Survey: 1.80% Prior: 1.80% | |

| Core PCE QoQ, 3Q T Survey: 2.10% Prior: 2.10% | |

| 10:00 AM | Personal Income, Nov Survey: 0.30% Prior: 0.00% |

| Personal Spending, Nov Survey: 0.40% Prior: 0.30% | |

| Real Personal Spending, Nov Survey: 0.20% Prior: 0.10% | |

| PCE Deflator MoM, Nov Survey: 0.20% Prior: 0.20% | |

| PCE Deflator YoY, Nov Survey: 1.40% Prior: 1.30% | |

| PCE Core Deflator MoM, Nov Survey: 0.10% Prior: 0.10% | |

| PCE Core Deflator YoY, Nov Survey: 1.50% Prior: 1.60% | |

| U. of Mich. Sentiment, Dec F Survey: 99.2 Prior: 99.2 | |

| 11:00 AM | Kansas City Fed Manf. Activity, Dec Survey: -3 Prior: -3 |

Canadian Economic Data

| 08:30 AM | Retail Sales MoM, Oct Survey: 0.50% Prior: -0.10% |

| Retail Sales Ex Auto MoM, Oct Survey: 0.20% Prior: 0.20% | |

| New Housing Price Index MoM, Nov Survey: 0.10% Prior: — | |

| New Housing Price Index YoY, Nov Survey: 0.00% Prior: — |

Disclosure and Disclaimer

The following sources of information have been, or may have been, used partially or in their entirety to compile the herein provided CTI Capital Securities Inc. (“CTI Capital”) ‘Morning Comments.’ CTI Capital believes these sources to be generally reliable, however, as said sources are varied and from third parties, CTI Capital cannot guarantee the accuracy or completeness of said information: Canadian Press (CP); Bloomberg News (BN); Wall Street Journal (WSJ); Stone & McCarthy Research Associates (SMRA); New York Times (NYT); Financial Times (FT); Market News International (MNI); Globe and Mail; Associated Press (AP); CNW Group (CNW); Reuters; Business News Network (BNN); Market Watch; and others.

Ivan Greenstein, Stephan Buu, Émile Bordeleau

Institutional Bond and Equity Desk

CTI Capital Valeurs Mobilières Inc.

Tel : (514)-861-0240

Fax: (514)-861-3230

Institutional Bond and Equity Desk

CTI Capital Valeurs Mobilieres Inc.

Tel : (514)-861-0240

Fax: (514)-861-3230