Portfolio Management

Knowledge is PowerPortfolio Management

CTI helps to create wealth for its clients through its extensive market expertise. The best financial models developed by our research department were deployed to portfolio development: CTI Fixed Income Active Portfolio for our institutional clients and CTI ePortfolios for our retail customers.

Additional Information

Investors Relations

Phone: (514) 861-3500

Email: info@cticap.com

Institutionals Clients and High-Net-Worth (HNW) individuals

Retail Clients

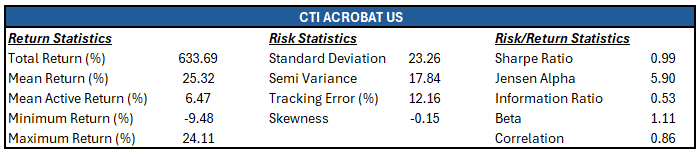

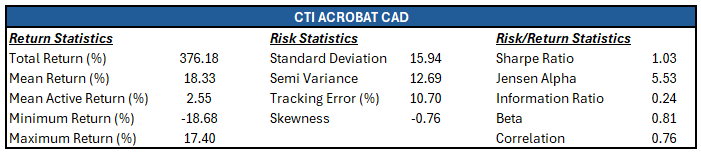

CTI Acrobat, North America

At CTI Capital, a leading dealer and investment firm with over 35 years of experience, we offer institutional and accredited investors a unique opportunity to achieve superior performance through our strategically managed portfolio, which spans both Canadian and U.S. stock markets. Our proprietary market models are designed to outperform similar indices through a risk-adjusted framework.

What sets CTI Capital apart is our cutting-edge expertise in data science, statistical analysis, and financial modeling, which has dramatically enhanced our ability to foresee revenues, cash flow, and earnings across multiple sectors. This allows us to anticipate and adapt to market changes, reduce risk, and consistently deliver optimized returns that aim to surpass industry benchmarks.

CTI Acrobat US & CAD vs. Benchmarks

Total Return (%) ― 10-Year Historical Performance

Performance results prior to December 2024 are based on simulated data. Past performance, whether actual or simulated, is not indicative of future results.

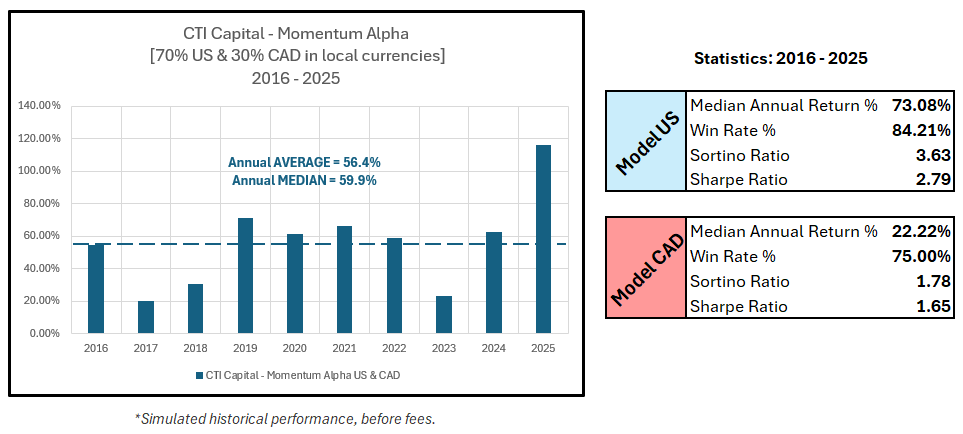

Alternative Investment Strategy:

CTI Momentum Alpha Model

We offer institutional investors and qualified investors with a high risk tolerance the opportunity to allocate a targeted portion of their portfolios to this alternative management mandate, specifically designed to optimize risk-adjusted value creation.

The CTI Momentum Alpha Model implements a dynamic and opportunistic allocation across securities and indices exhibiting the strongest momentum characteristics. This exposure is selectively enhanced through disciplined leverage, enabling efficient participation in market expansion phases while operating within a strict and robust risk-control framework.

Strategy Objectives

Maximize capital appreciation through concentrated, leveraged exposure to the most persistent upward trends, supported by tactical diversification between Canadian and U.S. markets.

Preserve capital and monetize corrective phases via the disciplined integration of active hedging mechanisms and targeted short positions, deployed when market-regime deterioration signals are confirmed.

Investment Framework

The strategy is built on a proven quantitative architecture centered on:

-

systematic identification of relative-strength signals,

-

accelerated tactical rotation of exposures,

-

rigorous risk management incorporating stress scenarios, maximum drawdown thresholds, and continuous correlation monitoring.

This approach is designed for investors seeking not only superior absolute performance, but also a structural edge that enables disciplined and agile navigation across market cycles.

Investment Conviction

Our conviction is straightforward: momentum is a structural force in financial markets. When combined with intelligently calibrated leverage and active defensive mechanisms, it becomes a durable source of alpha within institutional portfolios.

The CTI Momentum Alpha Model embodies a management philosophy where conviction is consistently balanced by quantitative discipline.