Comments

Monthly Market Recap: September 2025

Overview

September defied its reputation as a difficult month for equities, with major U.S. indexes reaching record highs and delivering their strongest September performance in more than a decade. The U.S. Federal Reserve (Fed) and the Bank of Canada (BoC) each lowered their key interest rates by 25 basis points, boosting market sentiment and increasing risk appetite. In the U.S., gains were concentrated in technology and artificial intelligence related sectors, while Canadian markets were led by strong results in the Materials sector. The main question now is how policy easing will balance the pressures of persistent inflation and a weakening labor market.

U.S. Market Performance and Policy

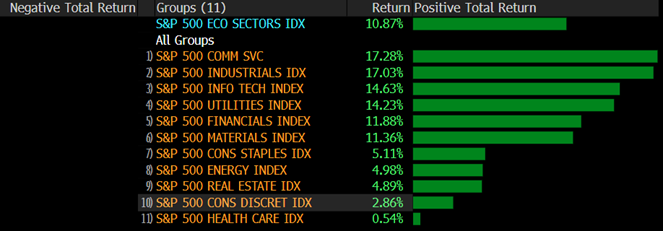

The S&P 500 rose 3.5% in September, marking its strongest performance for the month in nearly fifteen years. The NASDAQ 100 was the standout index, gaining 5.5% and reaching new record highs. The rally broadened as the small cap Russell 2000 also hit new records. Returns were driven mainly by large cap Technology and Communication Services stocks, continuing the momentum from the ongoing artificial intelligence investment cycle. Defensive sectors such as Consumer Staples underperformed.

The key market event was the Federal Reserve’s decision to reduce its target rate by 25 basis points to a range of 4.00 to 4.25%. The move signaled a focus on addressing a softening labor market even as inflation remains elevated. Looking ahead, investors will watch the September employment report and inflation data to assess the likelihood of further rate cuts, while also following the broader effects of tariff policies and the threat of a government shutdown.

Key Economic Data

- Fed Funds Rate (Target Range): Lowered by 25 basis points to 4.00 to 4.25%

- U.S. Unemployment Rate (August): Increased to 4.3%, the highest level since October 2021

- Consumer Confidence Index: Dropped to 94.2, the lowest reading since April

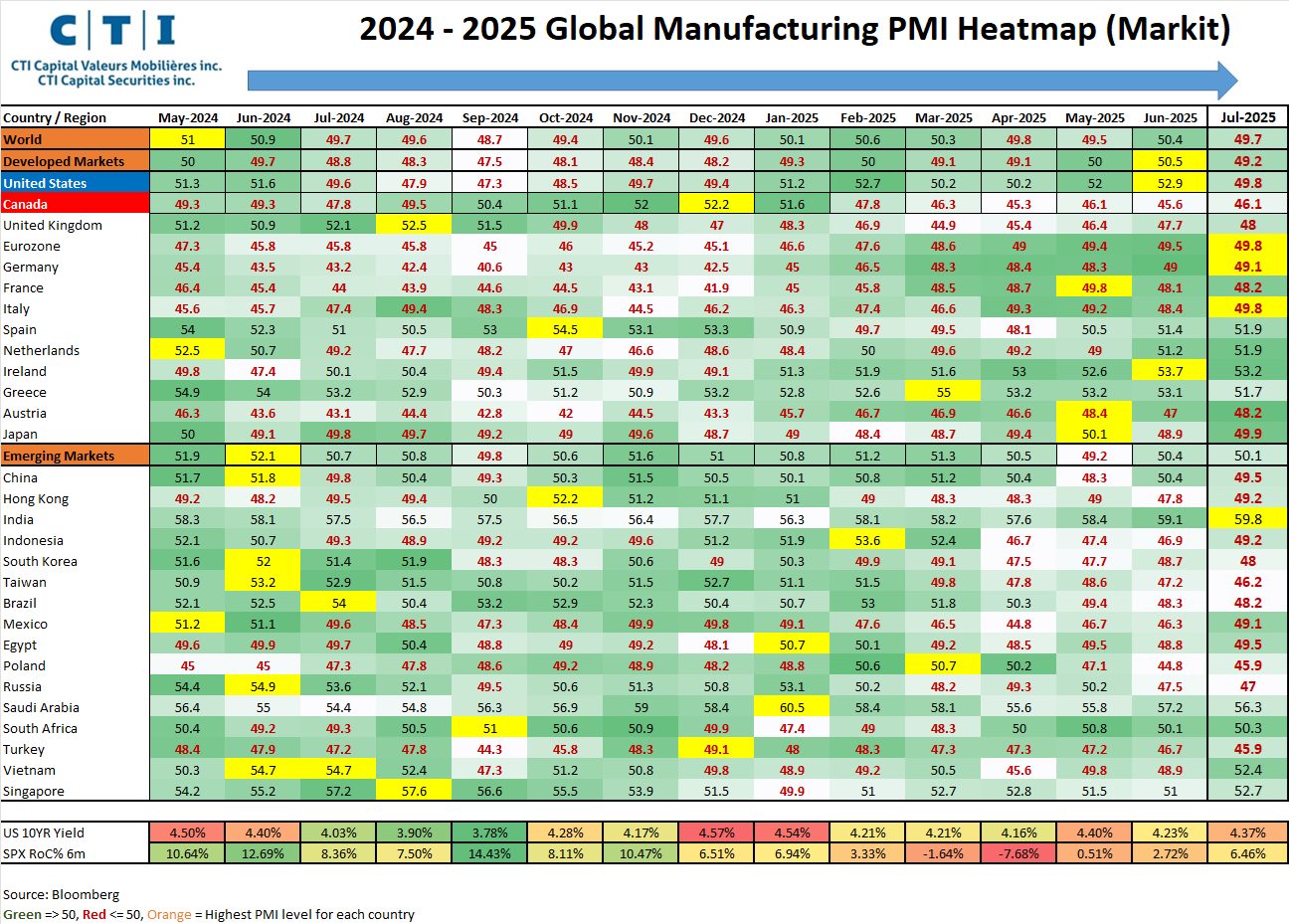

- ISM Manufacturing PMI: Registered at 49.1, showing a seventh consecutive month of contraction, though at a slightly slower pace than in August

- ISM Services PMI: Held steady at 50.0, but the Business Activity component recorded its first contraction since May 2020

Markets enter the final quarter with cautious optimism. Monetary easing, robust corporate earnings, and resilient fundamentals provide support, while risks tied to valuations, consumer sentiment, and political developments remain key factors to monitor.

Canadian Market Overview

The S&P and TSX Composite Index ended September with a solid gain of 5.1%, reaching new record highs. As in the U.S., the Bank of Canada served as a major catalyst by cutting its policy rate by 25 basis points to 2.50%. The adjustment aimed to support the domestic economy at a time when inflation remains below the 2 percent target and early signs point to a softer labor market.

The Materials sector was the strongest performer for the month, supported by global demand and improved risk sentiment. Foreign investment in Canadian securities was also robust, with international investors purchasing 31.3 billion dollars, primarily in Canadian debt securities. With trade tensions between Canada and the U.S. still present, policymakers continued to advocate for broader trade diversification with global partners, a factor that remains central to Canada’s long term outlook.

Key Economic Data

- Bank of Canada Rate: The policy rate was cut by 25 basis points to 2.5%, the lowest since July 2022, as officials pointed to slowing growth and moderated inflation.

- Unemployment Rate: The national unemployment rate rose to 7.1%, reaching a nine-year high, with pronounced job losses in goods-producing sectors.

- Consumer Confidence: The Ipsos index remained slightly negative at -5, reflecting cautious sentiment toward the macro backdrop.

- Manufacturing PMI: The PMI ticked lower to 47.7, still below expansion levels but still above the lows of the first quarter of 2025.

The strong performance in September reflects investors’ willingness to look beyond short term economic weakness in response to central bank support. Looking ahead, market participants are expected to monitor the trajectory of Canadian exports amid shifting trade arrangements, the resilience of labour markets, and the path of inflation, which recently moderated below the bank’s 2% target.

Monthly Market Recap: August, 2025

Overview

CTI Capital’s monthly review finds that markets entered August cautiously after record-setting July gains. Early weakness came from soft labor data, tariff concerns, and rising bond yields. Resilient corporate earnings and expectations of a Federal Reserve policy shift helped stabilize sentiment by month-end.

U.S. Market Performance & Policy

On August 1, equities sold off sharply, with the Dow down 500 points. Still, the S&P 500 stayed more than 25% above April lows and the Nasdaq over 35% higher, lifted by Microsoft, Meta, and other large firms.

Focus shifted quickly to the Fed. Futures priced in an ~89% chance of a September rate cut, supported by weaker data and policymakers’ willingness to ease if needed.

Key Economic Data (FRED):

- Fed Funds Rate: 4.33% (unchanged in July)

- Unemployment: 4.2%, up from June

- M2 Money Supply: $22.1 trillion, rising gradually

Consumer & Corporate Trends

Confidence softened as the Conference Board index fell to 97.4, with inflation expectations at 6.2% on essentials. At the same time, U.S. buybacks topped $1 trillion YTD, led by Apple, Alphabet, and JPMorgan.

Economic activity was mixed but resilient: manufacturing hit a three-year high at 53.3, while services held at 55.4, signaling expansion despite cost pressures.

Canadian Market Update

The S&P/TSX Composite hovered near 22,500 in August, weighed by softer energy prices but supported by financials and industrials. Oil slipped below $77, dragging resource stocks lower, though banks and infrastructure names held firm.

BNN Bloomberg highlighted investor focus on Bank of Canada policy. Markets now see elevated odds of an October rate cut as inflation cools. Housing activity steadied, with sales volumes improving in Ontario and British Columbia despite high mortgage rates.

The Globe and Mail’s Report on Business noted strong bank earnings, underpinned by robust capital and stable credit quality. Corporate investment in technology and infrastructure continues to offset commodity headwinds, suggesting moderate but steady growth heading into the fall.

Outlook

In the U.S., strong earnings and the prospect of Fed easing support cautious optimism. In Canada, resilient banks and central bank flexibility provide stability, though energy markets and trade remain watchpoints.

26/08/2025 – Global Manufacturing PMI Heatmap (Markit)