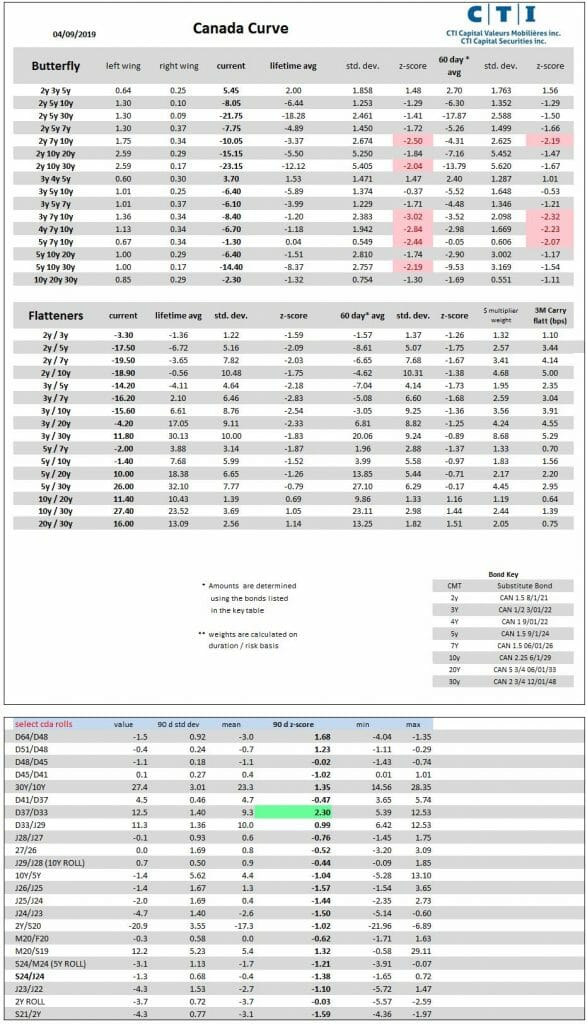

The BOC expected to leave rates unchanged at 1.75% and issue a cautious outlook given uncertainties over trade. Since the July MPR , the Canadian economy has remained relatively robust , with Q2 GDP coming in at 3.7% vs 2.3% forecast in MPR. Meanwhile inflation has hovered close to target and core prices have moved higher. Still a key forward looking indicator, the Markit PMI, fell to 49.1 in August, pointing to weakness in manufacturing. The outsized contribution from exports (+5.5% in Q2) is unlikely to be sustained , indeed international trade reverted back to deficit in July according to this morning’s STCA figures. Short end pricing might seem aggressive, with the 2Y/3Y roll at -3.3bps , yet we prefer to wait post BOC to fade the inversion at the short end.

Disclosure and Disclaimer

The following sources of information have been, or may have been, used partially or in their entirety to compile the herein provided CTI Capital Securities Inc. (“CTI Capital”) ‘Morning Comments.’ CTI Capital believes these sources to be generally reliable, however, as said sources are varied and from third parties, CTI Capital cannot guarantee the accuracy or completeness of said information: Canadian Press (CP); Bloomberg News (BN); Wall Street Journal (WSJ); Stone & McCarthy Research Associates (SMRA); New York Times (NYT); Financial Times (FT); Market News International (MNI); Globe and Mail; Associated Press (AP); CNW Group (CNW); Reuters; Business News Network (BNN); Market Watch; and others.

Ivan Greenstein, Stephan Buu, Émile Bordeleau

Institutional Bond and Equity Desk

CTI Capital Valeurs Mobilières Inc.

Tel : (514)-861-0240

Fax: (514)-861-3230

Institutional Bond and Equity Desk

CTI Capital Valeurs Mobilieres Inc.

Tel : (514)-861-0240

Fax: (514)-861-3230